Key Points:

- The US Federal Reserve’s aggressive monetary tightening is impacting the global financial system.

- US interest rates and a strong dollar are disrupting cross-border capital flows and straining the finances of countries holding large amounts of dollar-denominated debt.

- US monetary policy has historically shaped cross-border capital flows and debt-servicing sustainability.

- The Fed’s policies will impact the global financial system, but the extent of the impact is uncertain.

- Two historical scenarios, involving Ben Strong and Paul Volcker, provide insights into how the Fed may respond to global financial stability concerns.

- Ben Strong’s accommodative monetary policy in the 1920s led to rampant speculation and the Great Depression.

- Paul Volcker’s focus on taming US inflation in the 1980s had negative consequences for other countries, particularly Latin America.

- The Fed is likely to prioritize domestic concerns in its monetary policy decisions.

- Foreign governments should prepare for policies similar to Volcker’s with some possibility of accommodating measures.

Introduction

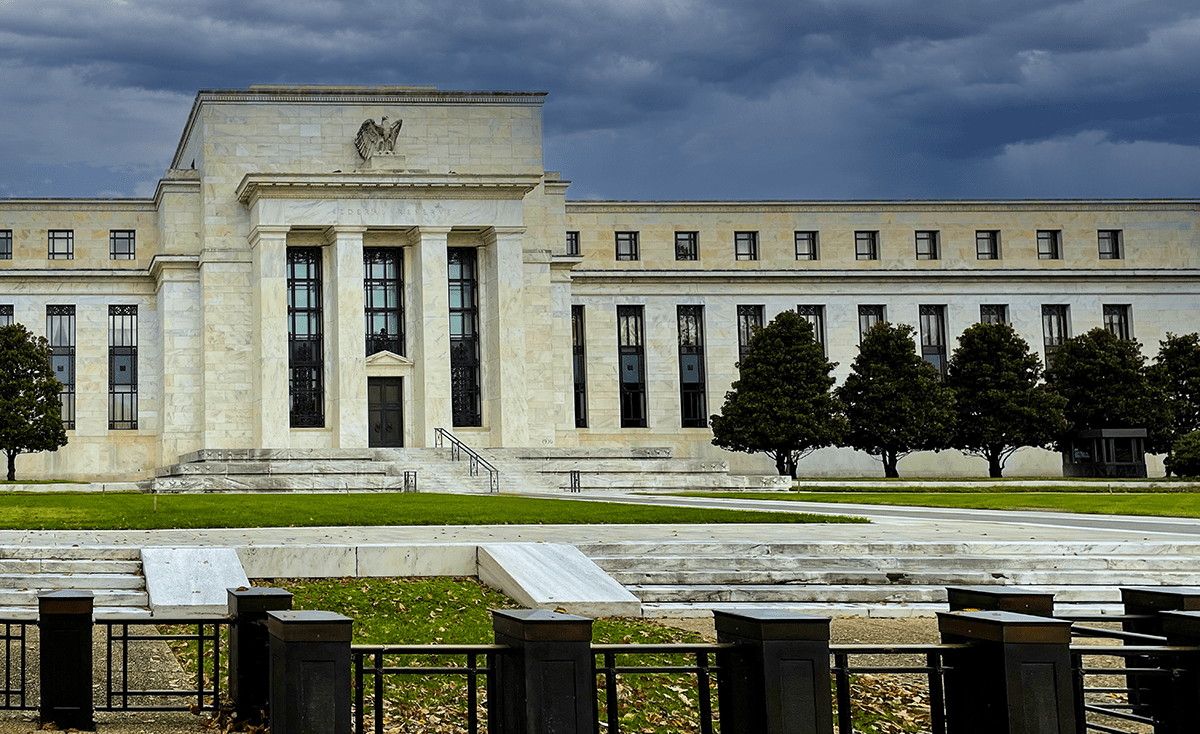

The US Federal Reserve’s monetary tightening measures have raised concerns about global financial stability. The impact of these measures on the global financial system is significant, with disruptions in cross-border capital flows and strains on countries holding large amounts of dollar-denominated debt. The Fed’s monetary policy has historically played a crucial role in shaping global capital flows and debt-servicing sustainability. As the world’s largest creditor and primary reserve currency issuer, the United States wields significant influence over international monetary policies.

Fed Policy and Global Financial Stability

The United Nations Conference on Trade and Development has warned of potential severe ramifications in vulnerable nations due to the Fed’s policies. However, predicting how these policies will play out globally is challenging. One question worth considering is whether the Fed will adjust its policies in the interest of global financial stability.

Historical Scenarios: Ben Strong and Paul Volcker

Examining two historical scenarios involving Ben Strong and Paul Volcker provides insights into how the Fed may respond to global financial stability concerns.

Scenario 1: Ben Strong and the Roaring ’20s

In the 1920s, the Fed tightened monetary policy aggressively to control inflation. However, this led to a short but sharp depression. The economy recovered, but it started overheating in the mid-1920s. The Fed faced pressure from European central bankers to keep interest rates low to prevent gold outflows. The Fed’s accommodative monetary policy fueled rampant speculation, eventually leading to the catastrophic crash in 1929 and the Great Depression.

Scenario 2: Paul Volcker and the Great Inflation

In the late 1970s, Fed chair Paul Volcker implemented a monetary tightening program to tackle US inflation. Other nations, especially in Latin America, suffered as the sharp increase in US interest rates caused their currencies to devalue. Despite international consequences, Volcker prioritized taming US inflation and focused on domestic concerns. This approach distinguishes Volcker’s policies from Ben Strong’s.

Implications for Global Monetary Policy

It is unclear how the Fed will adjust its policies considering their global impact. However, indications suggest that the Fed will follow Volcker’s model more than Strong’s. The current domestic focus in the United States will likely influence the Fed’s decisions. Foreign governments should be prepared for policies similar to Volcker’s, with some possibility of accommodating measures.

Conclusion

The US Federal Reserve’s monetary policy decisions have far-reaching implications for global financial stability. Historical scenarios involving Ben Strong and Paul Volcker provide valuable insights into the Fed’s potential approach. While the Fed’s policies may disrupt the global financial system, the focus on domestic concerns suggests that foreign governments should anticipate policies similar to Volcker’s with some potential for accommodation.