- The FX market is the largest, most liquid market in the world, but also one of the least understood.

- The FX Global Code was developed to promote fairness, transparency, and integrity in the FX market.

- The Code outlines six principles that market participants are expected to adhere to.

- While sell-side participants have largely adopted the Code, buy-side adoption has been slower.

- Adhering to the Code has helped improve governance, policies, and procedures for RBC Global Asset Management.

- Signing the Code benefits both market participants and clients, promoting efficient and ethical functioning of the FX market.

- All buy-side professionals should commit to globally recognized best practices to improve the FX market.

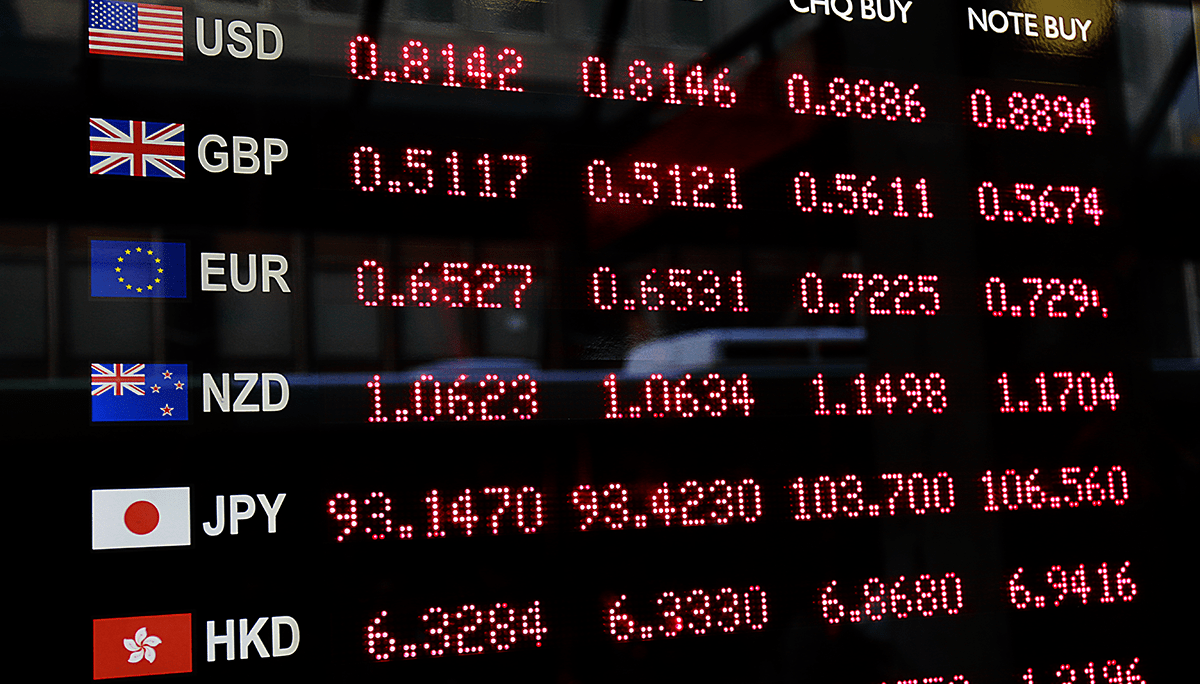

The foreign exchange (FX) market, with its $2.1 trillion daily spot turnover, is the largest and most liquid market in the world. However, it is also one of the least understood markets. The FX market operates over the counter (OTC) and connects participants across different jurisdictions, facilitating a further $5 trillion in derivatives transactions daily.

In response to the lack of transparency and oversight in the FX market, central bank governors launched the FX Global Code in 2015. The Code, a comprehensive document outlining industry best practices, aims to promote fairness, transparency, and integrity in the market. It is not part of regulatory frameworks in most jurisdictions and is voluntary for market participants.

The Code is organized around six principles: ethics, governance, execution, information sharing, risk management and compliance, and confirmation and settlement processes. Market participants are expected to adhere to these principles and promote good governance and practices in the FX market.

Although sell-side participants have largely adopted the Code, buy-side adoption has been slow. Limited resources, the voluntary nature of the Code, and the perception that it is a “sell-side thing” are among the reasons for the poor buy-side uptake. However, buy-side participants, including asset managers, should recognize the benefits of signing on to the Code and adhering to its principles.

For RBC Global Asset Management, adhering to the Code has brought various benefits. It has served as a training and education tool, prompted a review of policies, empowered trading staff to demand best execution practices, enabled continuous improvement of policies and procedures, and increased confidence in internal governance framework. Signing the Code also benefits clients by integrating a global standard and ensuring an efficient and ethical functioning of the FX market.

As the FX market continues to grow and evolve, all buy-side professionals should commit to globally recognized best practices. The FX Global Code provides a framework to improve the functioning and integrity of the market, and signing on to the Code is a commitment to promoting fairness, transparency, and ethics in the FX market.