Key Points

- Human capital, financial capital, and social capital are the three forms of capital essential for a successful finance career.

- Human capital refers to knowledge and skills gained through education and experience.

- Financial capital is necessary to invest in oneself and take risks.

- Social capital, built through trust, respect, and helping others, can open doors and create opportunities.

- A combination of these three forms of capital has helped Eric Sim, CFA, achieve financial success in his career.

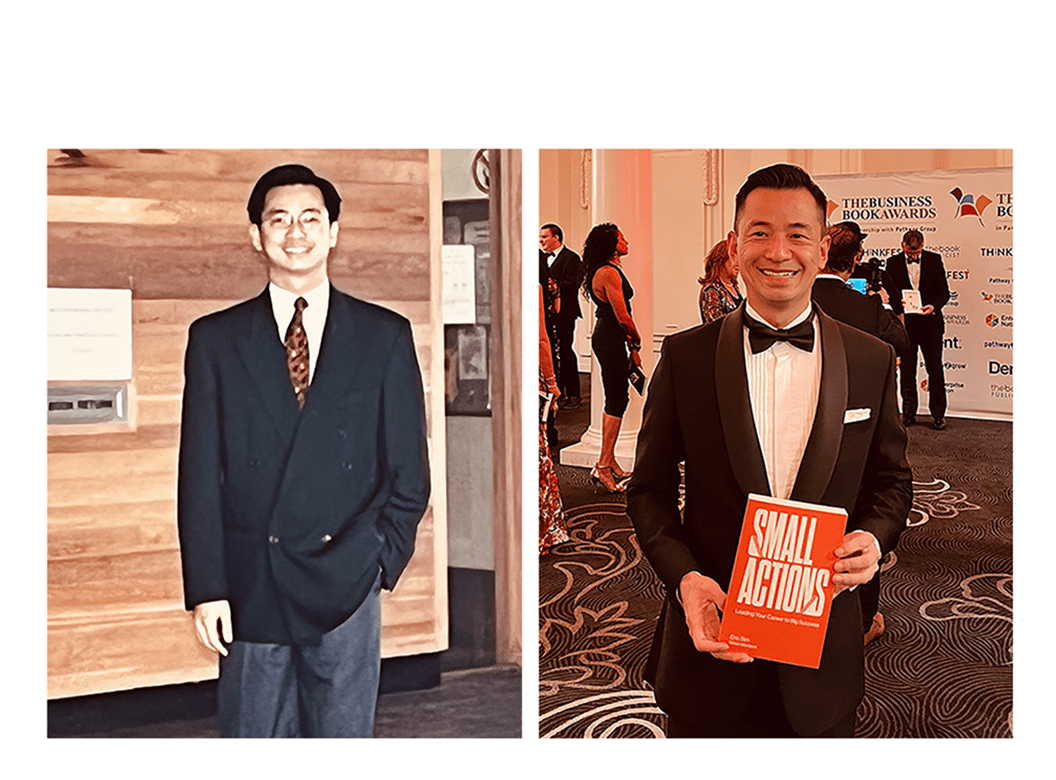

Eric Sim, a highly accomplished finance professional and author, attributes his success to the three pillars of capital: human, financial, and social. Throughout his career, Sim has recognized the importance of these forms of capital and how they have influenced his professional journey.

Human Capital

Human capital refers to an individual’s knowledge and skills. Sim believes that one must first possess human capital in order to be useful to others and build other forms of capital. He acquired his human capital through education and experience, starting with a degree in engineering from the National University of Singapore. Despite not having a traditional finance background, Sim leveraged his unique storytelling skills to secure a corporate sales position at DBS Bank.

Financial Capital: Not Rolex, But Timex

Financial capital plays a crucial role in taking risks and investing in oneself. Sim, coming from a blue-collar background, had little experience with the extravagant spending culture in banking and finance. Instead of splurging on luxury items, he chose to invest his bonus in stocks and use the remaining funds to pursue a master’s in finance program at Lancaster University. Sim made a calculated decision to invest in his future and change his fate.

Culture Shock

Sim’s journey abroad to study in the United Kingdom was not without its challenges. The culture shock, coupled with financial constraints, created obstacles for him. Despite facing these difficulties, Sim excelled in his financial mathematics course, showcasing his human capital and proving his abilities. After completing the program, Sim was confident and ready to take the next step in his career.

The Chicken Suit

Sim’s lack of financial capital became evident when he had to finance a new business suit for job interviews in London. With limited funds and limited options, he settled for a secondhand suit that was ill-fitting. This sartorial choice did not make a good impression on London bankers, highlighting the importance of personal presentation and financial capital in a professional setting.

Social Capital

Social capital, the third form of capital, is less tangible but equally important. It is built through relationships, trust, and respect. Sim emphasizes the significance of treating people with respect and helping them, as these actions contribute to building social capital. However, Sim lacked social capital in the UK, which hindered his job search and highlighted the importance of strong local networks.

Social Capital at Work

After returning to Singapore and navigating the Asian economic crisis, Sim landed a risk management position at Standard Chartered Bank. It was during this time that he pursued the CFA charter, further enhancing his human capital. The CFA designation served as a valuable tool for building social capital, as it signified his expertise and knowledge to finance professionals globally.

Through his career, Sim focused on excelling at his work and cultivating social capital. He actively helped colleagues and built relationships, leading to referrals and job opportunities. The trust and rapport he established with others became instrumental in his career advancement.

The Foundation of Social Capital: Trust

Trust is a fundamental component of building social capital. Sim learned the importance of trust early on, starting with an experience at his father’s noodle stand. The principle of upholding high standards, even when nobody is watching, became ingrained in Sim’s professional life and contributed to the trust he built with others.

Sim’s social capital and the trust he cultivated were critical factors in securing a managing director position at UBS Investment Bank, the pinnacle of his corporate career. The relationships and reputation he had built over the years played a significant role in this accomplishment.

Conclusion

Eric Sim’s career journey demonstrates the importance of human capital, financial capital, and social capital in achieving professional success in the finance industry. Through continuous learning, making calculated investments, and building trust with others, individuals can cultivate these forms of capital and create opportunities for themselves.

For more insights from Eric Sim, CFA, and his perspectives on leading a successful career, check out his book Small Actions: Leading Your Career to Big Success.