Central banks around the world are raising interest rates in response to increasing inflation. In June, the US Federal Reserve announced its largest rate hike since 1994. The Bank of England (BOE) and the central banks of Brazil, Canada, Australia, and the European Central Bank (ECB) have also raised rates. These rate increases not only create turmoil in risk markets, but they can also threaten a company’s financial stability.

Quantifying how these rate hikes will affect a company’s bottom line requires a strategic and holistic approach. The impact on financing costs is obvious, but understanding the effects on economic value requires a deeper analysis.

In this article, we demonstrate how the effect of rate increases varies depending on the company’s assets and liabilities. This calculation becomes even more complex for finance or investment firms that manage multiple balance sheets. However, financial risk management and market risk hedging are crucial for every firm’s success, so it is important for analysts to understand the available tools.

Economic Value of Equity (EVE)

Economic value of equity (EVE), also known as net worth, represents the difference between a company’s assets and liabilities based on their respective market values. EVE reflects how assets and liabilities would be affected by changes in interest rates.

EVE is a widely used metric in interest rate risk calculations, particularly by banks measuring interest rate risk in their banking book (IRRBB). However, EVE can also help companies and analysts assess the risk to their assets and liabilities.

Calculating EVE involves comparing the present value of all expected cash flows on liabilities (market value of liabilities or MVL) with the present value of expected cash flows on assets (market value of assets or MVA). It is important to not only consider the static value of EVE but also analyze how it would change with each unit of interest rate movement. The change in EVE, denoted as ΔEVE, can be calculated as the difference between ΔMVA and ΔMVL.

One of the advantages of EVE is its ability to quantify the change in EVE for each time bucket. By analyzing the changes in a company’s EVE under different interest rate scenarios, analysts can identify the periods where the company is most vulnerable to rate increases.

Determining an Acceptable EVE

Long-term assets and liabilities are more susceptible to interest rate changes due to their stickiness, making them less likely to be re-fixed in the short term. By examining the net change in EVE across the interest rate curve, analysts can determine the buckets where the company is most vulnerable.

The optimal allocation between the duration and amounts of assets and liabilities varies for each institution. One size does not fit all. Each firm’s risk profile and pre-set risk appetite will drive the optimal EVE. Asset and liability management (ALM) plays a crucial role in translating a company’s risk profile into action.

Given that EVE is primarily a long-term metric, it can be volatile when interest rates change. This highlights the importance of applying market best practices such as value at risk (VaR) to anticipate and understand future interest rate movements.

Managing On and Off the Balance Sheet

A company can manage the EVE gap between assets and liabilities, and mitigate associated risks, either on the balance sheet or off it. On-balance-sheet hedging involves obtaining fixed interest rate financing instead of floating rate financing or issuing fixed bonds to align the duration gap between assets and liabilities.

Off-balance-sheet hedging maintains the mismatch between assets and liabilities but uses financial derivatives to replicate the desired outcome synthetically. Many firms utilize vanilla interest rate swaps (IRS) or interest rate cap derivatives for this purpose.

Although the details of the balance sheet gap may not always be readily available, decision-makers and investors must pay attention to it. The EVE metric captures the market value of cumulative cash flows over the coming years and offers a simple way to evaluate the company’s financial position.

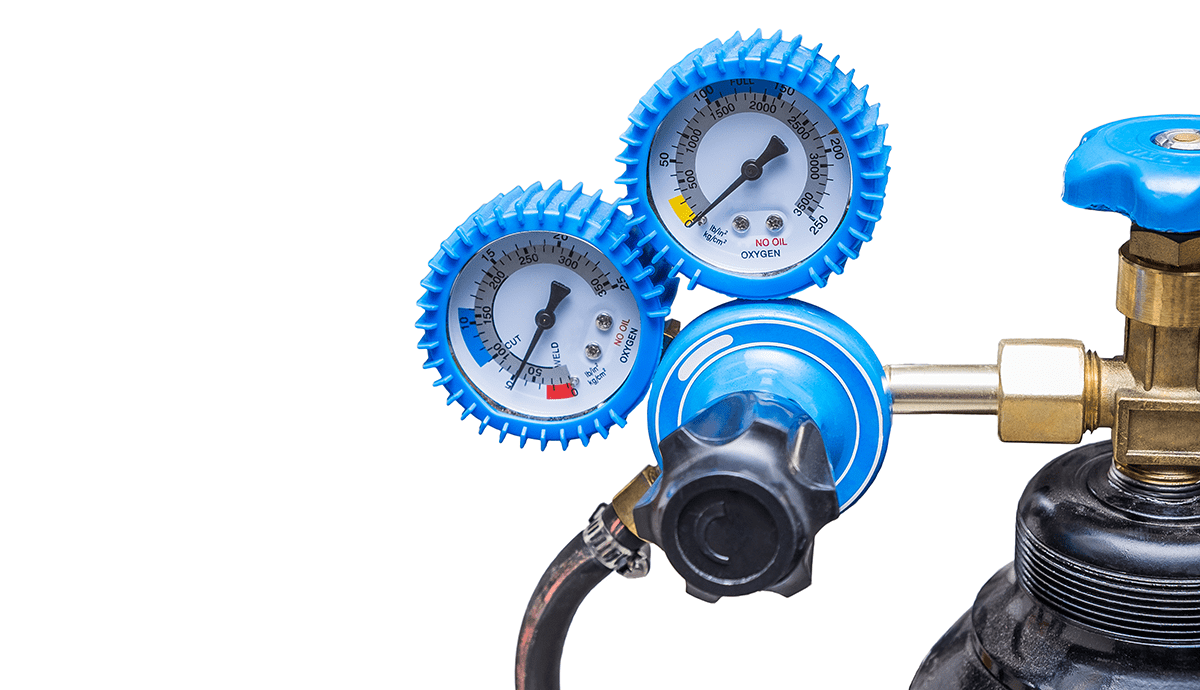

A Safety Valve for an Uncertain Future

By conducting thorough due diligence, analysts can gain insights into how a company manages its interest rate exposure and associated ALM processes. While banks and large financial institutions commonly use the EVE indicator, other companies and analysts can benefit from its application as well.

Setting limits for risks, monitoring them, and understanding the changes in value due to interest rate movements can provide a safety valve that protects against market risks and an uncertain interest rate outlook.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author and should not be construed as investment advice. The opinions expressed do not necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/Heiko Küverling

Professional Learning for CFA Institute Members

CFA Institute members can self-determine and self-report professional learning (PL) credits earned, including content from Enterprising Investor. Members can easily record credits using their online PL tracker.