Last updated on August 1st, 2023 at 04:48 am

In the dynamic realm of cryptocurrency, Bitcoin has garnered attention with its price fluctuations and the ever-changing nature of the market. Traders have experienced both the thrill of significant gains and the agony of substantial losses.

Table of Contents

This article provides an in-depth analysis of the recent events that have influenced the price of Bitcoin, explores the implications for traders, and investigates the potential factors that may shape its future path.

Understanding the Liquidation of Bullish Long Positions

Recently, many traders who held bullish long positions on Bitcoin found themselves facing unexpected liquidations. These liquidations occur when the price of an asset falls below a certain threshold, triggering an automatic closure of leveraged positions. As a result, traders incurred losses, and their positions were forcibly “rekt.”

When trading in the cryptocurrency market, traders often employ bullish long positions. It means they anticipate the price of a particular asset, such as Bitcoin, to increase over time.

However, there are inherent risks associated with such positions, especially when traders opt for leverage to amplify their potential gains.

The liquidation of bullish long positions occurs when the price of an asset, in this case, Bitcoin, falls below a predetermined threshold. This triggers an automatic closure of leveraged positions, resulting in the forced selling of the asset.

Essentially, traders who hold bullish long places find themselves where their positions are “rekt” or liquidated due to the downward movement of the price.

Key Factor in Liquidation of Bullish Long Positions

One key factor that exacerbates the impact of liquidation is high leverage. Using leverage, traders can increase their exposure to Bitcoin’s price movements, aiming for higher profits.

However, it also amplifies the risks involved. Even a moderate price drop can cause the position’s value to fall below the threshold, leading to liquidation.

The consequences of liquidation can be significant for traders. They face immediate losses and potentially lose the opportunity to profit from a future price increase.

Moreover, the forced selling resulting from liquidation can contribute to further downward pressure on the price, adding to market volatility.

Understanding the liquidation process and its implications is crucial for traders looking to navigate the cryptocurrency market successfully.

It highlights the importance of carefully managing leverage, setting appropriate stop-loss levels, and staying informed about market trends.

By being mindful of the risks and taking proactive measures, traders can mitigate potential losses and make more informed decisions regarding their trading strategies.

The Impact of High-Leveraged Positions in Rise and Fall of Bitcoin

High-leveraged positions in the cryptocurrency market profoundly impact traders’ risk exposure and potential returns. Many liquidated traders held high-leveraged positions within the $30,200 to $30,500 range.

High leverage allows traders to amplify their exposure to Bitcoin’s price movements, potentially leading to higher profits.

However, it also comes with increased risks, as even a moderate drop in price can trigger liquidations.

When traders opt for high leverage, they borrow funds to amplify their trading positions, intending to maximize profits.

However, high leverage comes with inherent risks. A significant consequence of high-leveraged positions is the increased susceptibility to liquidation.

Even a relatively small downward movement in the price of Bitcoin can cause the position’s value to drop below the liquidation threshold, resulting in forced selling and substantial losses for the trader.

High-Leveraged Positions Tend to Market Volatility

Moreover, high-leveraged positions can contribute to heightened market volatility. As traders rush to close their positions during market downturns, the influx of sell orders can exacerbate price declines and trigger a cascading effect.

It’s crucial for traders to carefully consider the risks associated with high leverage and exercise caution when employing this strategy.

Proper risk management techniques, such as setting appropriate stop-loss levels and diversifying investments, can help mitigate potential losses.

By understanding the impact of high-leveraged positions, traders can make more informed decisions and navigate the cryptocurrency market more confidently.

The Resurgence of Leverage and Volatility

The resurgence of leverage in the Bitcoin market indicates the rising leverage ratio, which measures the extent traders utilize borrowed funds.

While leverage can be an effective tool for maximizing returns, it also magnifies the volatility inherent in the cryptocurrency market.

When price swings become more erratic, the likelihood of liquidations rises, leading to increased market turbulence.

Leverage refers to borrowing funds to amplify trading positions, allowing traders to magnify their gains or losses potentially.

The re-emergence of leverage indicates a higher level of risk appetite among traders.

As more participants utilize force to increase their exposure to Bitcoin’s price movements, the potential for more significant market swings intensifies.

While it presents opportunities for significant profits, it also poses risks for traders. Sudden and drastic price fluctuations can liquidate leveraged positions, resulting in substantial losses.

Moreover, increased volatility can make it challenging to predict accurately and time market movements, adding to the complexity of trading decisions.

Must Read: Unlocking the Secrets of High Net Worth Financial Planning

As leverage and volatility continue to play interconnected roles in the Bitcoin market, it becomes imperative for traders to exercise caution.

Implementing risk management strategies, such as setting appropriate stop-loss orders, diversifying investments, and staying informed about market trends, can help mitigate potential losses and navigate the evolving landscape of leverage and volatility.

Understanding the relationship between leverage, volatility, and market dynamics is vital for traders to make informed decisions and effectively manage their risk exposure.

By staying vigilant and adapting to changing market conditions, traders can position themselves for success in the face of leverage-induced volatility.

The Influence of Bitcoin Spot-ETFs

The filing of Bitcoin spot ETFs by influential financial entities, such as BlackRock, has notably impacted the cryptocurrency market.

A spot ETF, an exchange-traded fund, allows investors to gain exposure to Bitcoin without directly owning the digital asset.

Must Read: How to Calculate Gain or Loss on Stock

This development has brought renewed optimism and bullish sentiment to the market.

The potential approval and launch of Bitcoin spot ETFs have significant implications for the broader adoption of cryptocurrency.

It paves the way for institutional investors, who typically rely on regulated investment vehicles, to participate in the Bitcoin market.

The involvement of established financial heavyweights adds credibility and legitimacy to the asset class, potentially attracting a more significant influx of capital.

However, it’s important to note that the approval process for spot ETFs is ongoing, and further updates are needed for increased clarity and optimism.

Regulatory authorities play a crucial role in determining the viability of these investment products and ensuring investor protection.

The Market Impact of Bitcoin spot ETFs

The influence of Bitcoin spot ETFs extends beyond the immediate market impact. These ETFs could contribute to normalizing cryptocurrencies in traditional investment portfolios, potentially diversifying risk and increasing market stability.

Traders and investors closely monitor the progress of Bitcoin spot ETFs, as their approval or denial can significantly affect market sentiment and price movements.

It is essential to stay informed about regulatory developments, keeping an eye on announcements and updates that may shape the future of Bitcoin as an investment vehicle.

As the landscape evolves, market participants must remain vigilant, assess the potential impact of spot ETFs, and adapt their strategies accordingly.

The emergence of regulated investment products like spot ETFs underscores the growing recognition of Bitcoin as a legitimate asset class. It opens up new avenues for market participants to engage with the cryptocurrency.

The Road Ahead for Bitcoin

Looking ahead, the future trajectory of Bitcoin remains subject to various factors and uncertainties. At the time of writing, Bitcoin is trading at $ 30,205.97 per (BTC / USD) with a current market cap of $586.95B, reflecting the current state of the market.

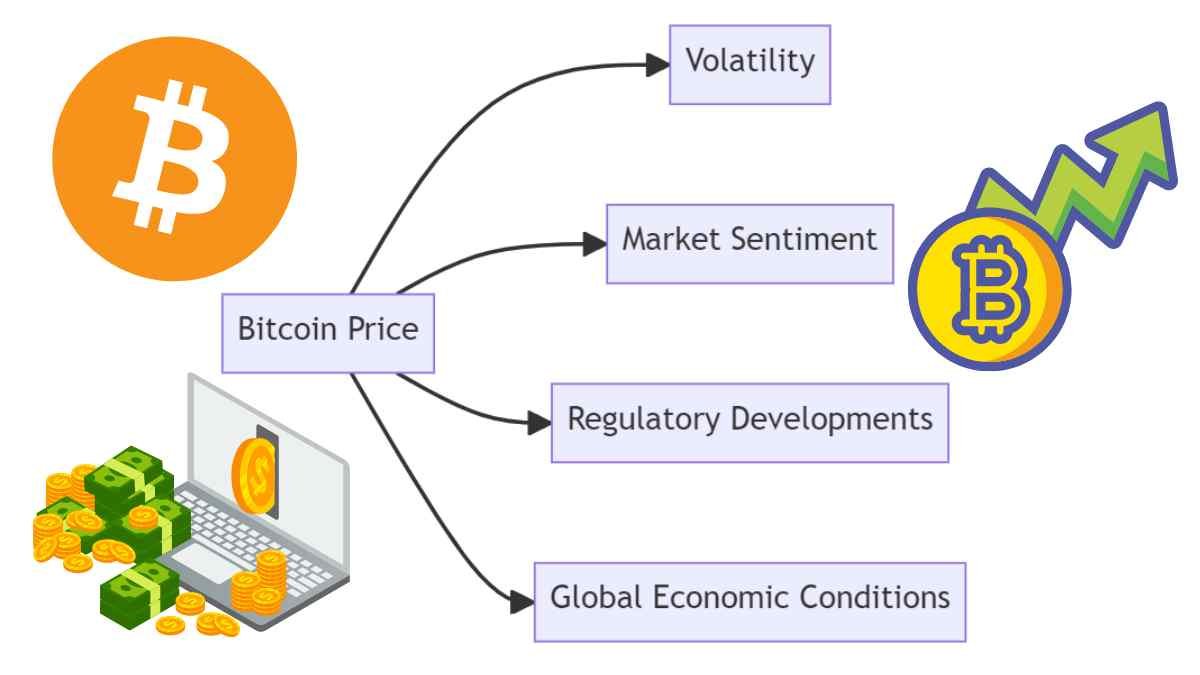

Several key factors will likely shape the road ahead for Bitcoin. Market sentiment is vital, as positive or negative perceptions can influence investor behavior and impact price movements.

Additionally, both domestically and internationally, regulatory developments will significantly impact the adoption and acceptance of Bitcoin.

Global economic conditions also play a role in shaping the future of Bitcoin. Factors such as inflation rates, geopolitical events, and monetary policies can affect investor sentiment and the overall demand for cryptocurrencies.

Furthermore, approving Bitcoin spot ETFs can open up new avenues for institutional investment and contribute to the broader adoption of cryptocurrencies.

Stay Updated on these Factors While Navigating the Bitcoin Market

Traders and investors must remain informed and stay updated on these factors while navigating the Bitcoin market.

Participants can make more informed decisions by conducting thorough research, monitoring market trends, and assessing the impact of critical events.

Must Read: Bitcoin and Ripple’s Legal Victory

While the future for Bitcoin may have uncertainties, the potential for growth and innovation within the cryptocurrency space remains significant.

Ultimately, staying informed, adapting to changing market conditions, and making well-informed decisions will be essential for individuals seeking to navigate the road ahead for Bitcoin successfully.

Conclusion

In conclusion, the recent liquidations of bullish long positions on Bitcoin, particularly those with high leverage, have highlighted the inherent volatility of the cryptocurrency market.

While the filing of Bitcoin spot ETFs has reignited bullish sentiment, it is essential to await further updates on ETF approvals for a clearer outlook.

Traders and investors must remain vigilant, adjust to the ever-evolving market conditions, and make well-informed decisions grounded in comprehensive research.

Remember, volatility is both a challenge and an opportunity in the world of Bitcoin.

By staying informed and understanding the market dynamics, traders can navigate the highs and lows, ultimately positioning themselves for long-term success.