- The top 10 most successful US investors include Warren Buffett, Charlie Munger, Jim Simons, and Benjamin Graham.

- Criteria for being considered a successful investor include a long track record of outperformance, the ability to uncover hidden truths, conviction in unpopular positions, preservation of competitive advantages, and the ability to pass on skills to future generations.

- Each investor on the list possesses a unique virtue that contributed to their success, such as skepticism, persistence, creativity, integrity, and mentorship.

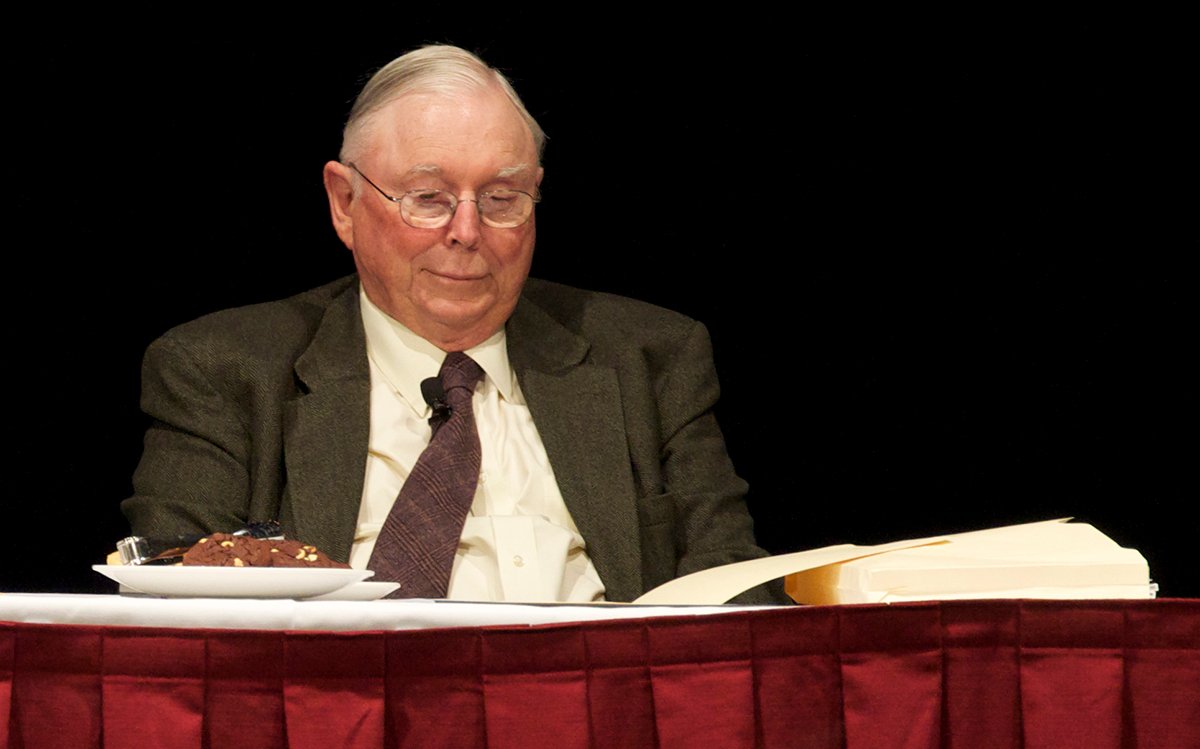

- The revised list of top US investors includes Hetty Green, Warren Buffett, Charlie Munger, Jim Simons, David Swensen, Benjamin Graham, George Soros, J. Pierpont Morgan, Ray Dalio, and Jay Gould.

- Hetty Green is considered the greatest investor due to her exceptional track record, the ability to thrive in a challenging environment, and the embodiment of all 10 virtues.

Andrew Mitchell, founder of Ophir Asset Management, recently asked ChatGPT to name the top 10 most successful US investors. The AI responded with a list that included Warren Buffett, Peter Lynch, Benjamin Graham, and George Soros, among others. However, the list prompted a discussion about the selection criteria and whether certain individuals were deserving of their positions.

The author of the article made revisions to ChatGPT’s list and provided his own ranking of the top US investors based on certain criteria. He believes that a successful investor must have a long track record of outperformance, the ability to uncover hidden truths, conviction in unpopular positions, preservation of competitive advantages, and the ability to pass on skills to future generations.

According to the author’s revised list, Hetty Green tops the ranking of the greatest US investors. She is followed by Warren Buffett, Charlie Munger, Jim Simons, David Swensen, Benjamin Graham, George Soros, J. Pierpont Morgan, Ray Dalio, and Jay Gould.

Each investor on the list possesses a unique virtue that contributed to their success. For example, Charlie Munger excels in skepticism, Ray Dalio in persistence, and Jim Simons in creativity. These virtues enable them to uncover valuable information, hold unpopular positions, and adapt to changing market environments.

The author emphasizes the importance of the virtues possessed by these investors and their ability to pass on their skills to future generations. It is these timeless qualities that set them apart and contribute to their long-term success.

Overall, the article provides insights into the characteristics and virtues of successful investors and offers a revised list of the top US investors based on these criteria.