Key Points:

- Policymakers in the US are hindering investors from conducting risk management by proposing and passing laws that make it illegal to consider the financial risks of climate change.

- Climate change poses financial risks, as droughts, heat waves, and extreme weather events can cause significant damage to infrastructure, supply chains, and facilities.

- Investors have integrated climate considerations into their decision-making because the financial effects are clear, and governments should not interfere with this process.

- Some states have instituted laws that forbid investors from taking climate change impacts into account, effectively penalizing risk management.

- Ignoring financial risks only makes them worse, and lack of data and freedom to act on that data hampers market efficiency and effectiveness.

- Investors and leaders in the private and public sectors are urging policymakers to protect every investor’s right to incorporate climate and sustainability risks into their decision-making process.

Risk management is an essential concept in financial analysis, but when it comes to climate change and sustainability, efforts are being made to impede investors from practicing it. Policymakers in the United States have proposed and even passed laws that make it more difficult, if not illegal, for investors to consider the financial risks of climate change.

However, these efforts are misguided, as the freedom to invest responsibly and the principle of risk management must be defended. To understand why, we need to go back to basics.

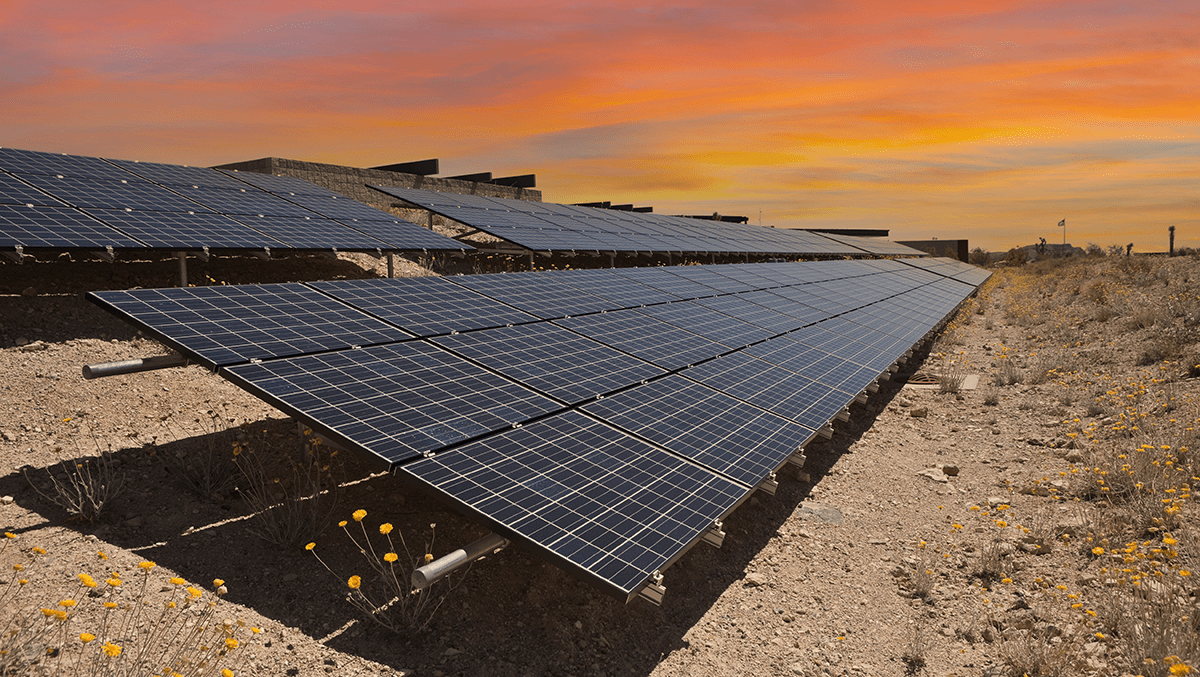

The answer to whether climate change poses financial risks is clear. Droughts, heat waves, and extreme weather events can cause significant damage to infrastructure, supply chains, facilities, and people. In fact, the United States recorded $165 billion in losses from climate disasters just last year. But the climate crisis also presents enormous opportunities. The clean energy boom driven by the Inflation Reduction Act is a clear example. Investors should not be excluded from participating in these opportunities.

Informed by these facts, investors have increasingly integrated climate considerations into their decision-making. They are acting on sound, rational logic, and governments should not interfere with this process. Unfortunately, some states have implemented laws that prohibit investors from taking climate change impacts into account when assessing bond issuances, pension fund management, and other government contracts. Essentially, they are penalizing risk management.

Ignoring a financial risk does not make it go away; it only makes it worse. Failing to account for potential threats has significant downsides, both on individual balance sheets and across the national economy. Investors need data to assess these risks and the freedom to act on that data based on their business considerations. It is their fiduciary duty to do so.

When investors lack these essentials, markets become less efficient and effective, and everyone invested in those markets suffers. Fewer financial institutions in the marketplace would force states to pay millions more in extra interest payments. Additionally, if states only work with institutions that do not consider climate- and sustainability-related risks, they expose their pension funds, beneficiaries, and taxpayers to the downsides of those risks.

Most investors understand the threat and are responding appropriately by studying the data, following trends, and monitoring risks and opportunities. However, being rational market actors is not enough.

That’s why investors, along with private and public sector leaders, are coming together to urge policymakers to protect every investor’s right to incorporate climate and sustainability risks into their decision-making process. They are making a clear statement that executing their fiduciary duty should not be subject to government interference. Such interference will only make it harder for them to do their jobs and serve their clients.

Therefore, it is crucial for all of us to stand up, speak out, and demand the freedom to invest responsibly.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / trekandshoot

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.