Key Points:

- Saudi Arabia’s economy is experiencing significant growth, with record numbers in credit facilities extended to the private sector.

- Interest rate risk is a key concern in project finance transactions in Saudi Arabia.

- The allocation of interest rate risk between the project company and the beneficiary entity needs to be carefully considered.

- Agreeing on an optimal hedging strategy and understanding the risk allocation is crucial for successful project finance.

- The four key stages of the project finance process require careful planning and coordination to manage interest rate risk effectively.

Saudi Arabia’s economy is currently witnessing a surge in growth, as evident from the record numbers in credit facilities extended to the private sector. This exceptional growth has also brought along the risk of interest rate volatility. The Saudi Arabian Interbank Offer Rate (SAIBOR) has shown a recent surge and rising volatility, posing challenges for project finance transactions in the country.

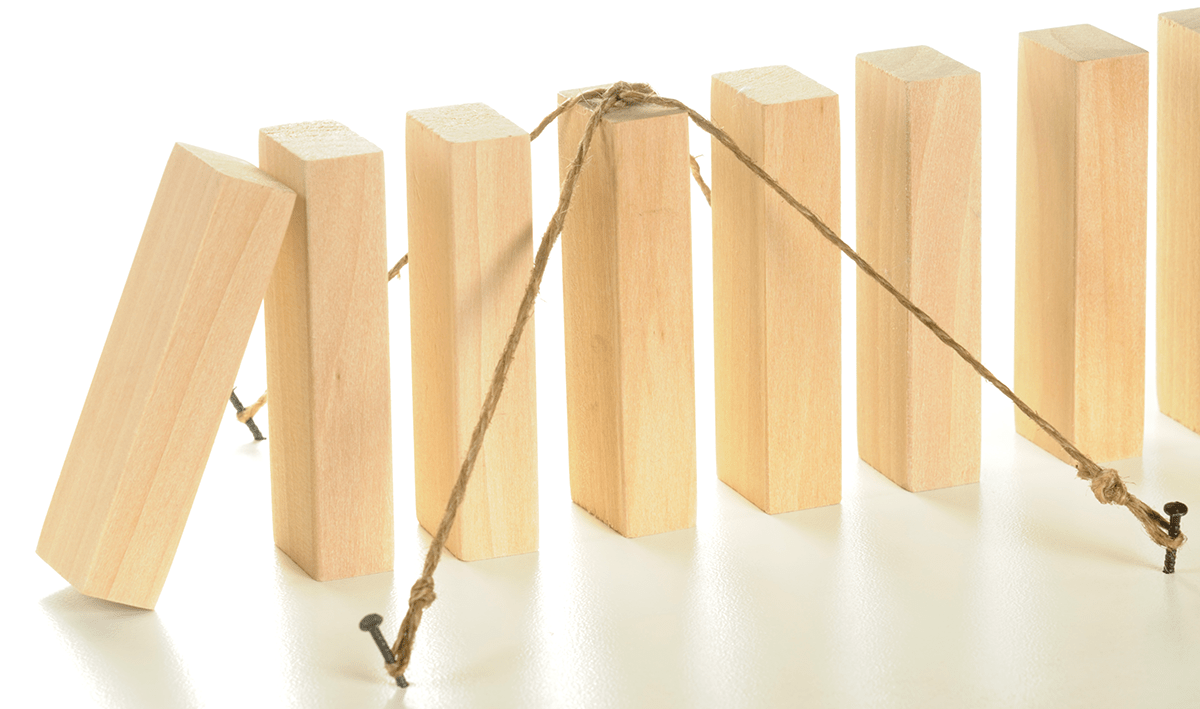

In project finance transactions, interest rate risk needs to be allocated between the two primary stakeholders: the project company and the beneficiary entity. The conventional approach in Saudi Arabia places the onus of interest rate risk on the beneficiary entities. These entities assume the interest rate risk as outlined in the initial financial model, with adjustments made if the interest rate deviates from the assumed rate at the execution date. This allocation ensures that the project company’s profitability is shielded from interest rate volatility until the hedge execution.

To achieve a balanced equation, it is crucial for the stakeholders to agree on an optimal hedging strategy and have a clear understanding of how interest rate risk is allocated. This can be achieved through careful planning and coordination at the four key stages of the project finance process.

1. The Pre-Bid Stage

In the pre-bid stage, the project company should devise and articulate a hedging strategy that specifies the optimal hedging quantum, duration, and instrument under consideration. It is important to obtain buy-in from lenders and hedge providers to ensure a smooth close-out. The project company should also calculate the interest rate risk allocation before submitting its bid and consider factors such as long-term financing and currency liquidity. Clear agreements on compensation and participation in gains and losses should be established.

2. The Post-Bid Pre-Financial Close Stage

At this stage, the project company’s grasp of the pre-bid stage agreement is crucial for the success of the project finance transaction. The project company should strive for agreement on the hedge credit spread and consider factors such as credit spread competition among hedge providers and mandatory hedging requirements. A drafted hedging protocol and a dry run of the hedge can help test the reliability of the protocol.

3. The Hedge Execution Stage

During the hedge execution stage, the project company should conduct a sanity check on the indicative hedge term sheets from hedge providers to identify any misalignment. All stakeholders should agree on the terms and outlook to avoid slippage costs and excessive execution charges. The best execution methodology should be discussed, considering factors such as hedge size, duration, and currency.

4. The Post-Hedge Execution Stage

After the hedge execution, the project company should carefully manage any unhedged portion of long-term debt and consider the interest rate risk allocation. Additional hedges may be permitted for a short timeframe before the initial hedge expires. The project company should also consider the accounting impact of derivative instruments and potentially apply the IFRS9 hedge accounting standard.

Overall, managing interest rate risk in project finance requires careful planning, coordination, and clear agreements between the project company and the beneficiary entity. Each project is unique, and a tailored hedging strategy is necessary. Setting expectations and defining responsibilities at the outset of the project can help ensure a smooth and seamless hedging process.