Last updated on July 23rd, 2023 at 08:48 am

Recently, cryptocurrency has skyrocketed in popularity, completely transforming our perspectives on and interactions with money. This article aims to provide you with a comprehensive exploration of the world of cryptocurrency, covering its foundational blockchain technology, offering insights into its intricate technology, discussing various investment strategies, contemplating its potential future, and exploring the intriguing concept of cryptocurrency mining. Join us on this informative journey as we navigate the exciting world of cryptocurrencies for shaping your financial future.

Table of Contents

Understanding the Blockchain in Cryptocurrency

The blockchain serves as the foundation for cryptocurrencies like Bitcoin. It is a decentralized and distributed database that ensures permanent, transparent, and secure data storage. The blockchain operates as a digital ledger, recording all cryptocurrency transactions.

Each block within the blockchain contains a cryptographic hash of the previous block, a timestamp, and the transaction data. Bitcoin nodes utilize the blockchain to differentiate legitimate transactions from attempts to double-spend coins.

The blockchain maintains by a network of computers known as nodes. These nodes verify transactions through a process called consensus. Once verified, the trades add to a block, chained to the previous blocks, forming an unalterable blockchain.

The blockchain is transparent, allowing anyone to view its contents while ensuring user anonymity. It achieves security through cryptographic hashes, making it resistant to fraud and hacking. This revolutionary technology can disrupt various industries, from banking to supply chain management.

The Technology Behind Cryptocurrencies

Cryptocurrencies, such as Bitcoin, rely on blockchain technology for their operation. Blockchain acts as a distributed ledger, recording all cryptocurrency transactions. The process starts with a transaction record in a block, which adds to the blockchain.

Miners, the computers within the network, verify these transactions and add them to the blockchain. Miners reward with cryptocurrency for their work. Verifying transactions and adding them to the blockchain is known as mining.

Cryptocurrencies are decentralized and not controlled by any government or financial institution. Cryptocurrency uses for purchasing goods and services or held as investments. The first and most well-known cryptocurrency, Bitcoin, was created in 2009.

Investing in Cryptocurrency

Investing in cryptocurrency can be exciting, but it’s essential to consider a few key factors:

Research: Before investing, thoroughly research the cryptocurrency you’re interested in. Study the team behind the project, the technology it utilizes, and the project’s roadmap.

Diversification: Just like any other investment, diversify your cryptocurrency investments. Avoid putting all your funds into a single cryptocurrency, as it can be risky. Spread your investments across different cryptocurrencies.

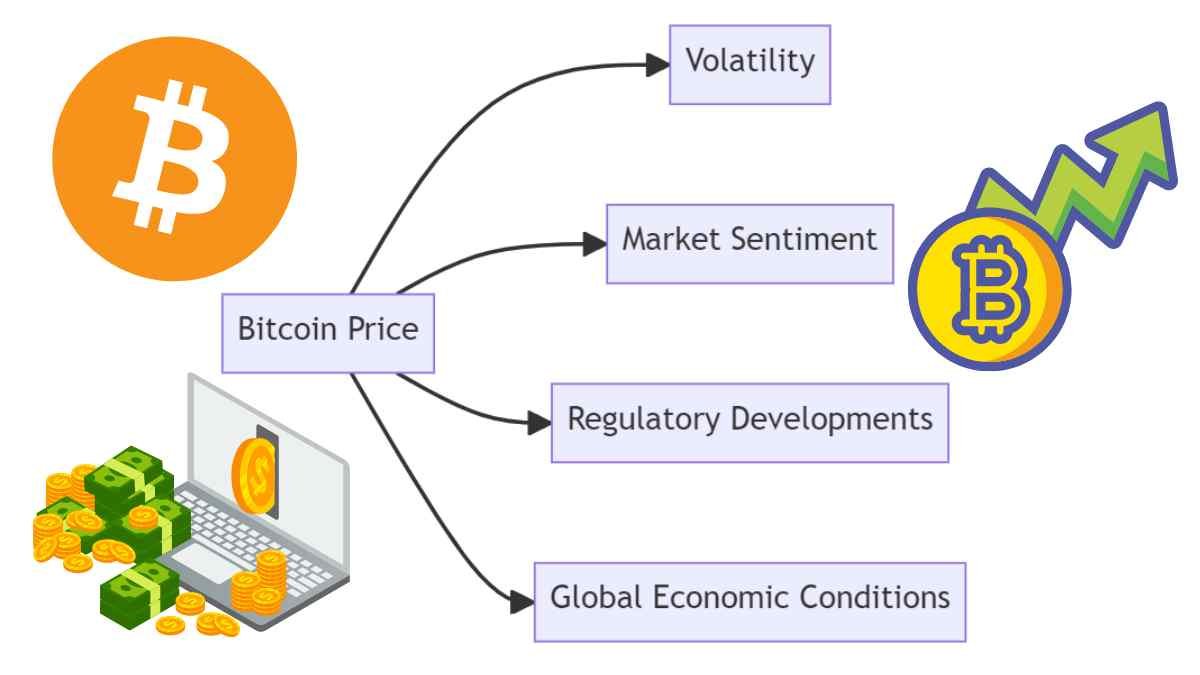

Volatility: Cryptocurrency markets are highly volatile. Be prepared for price fluctuations and market downturns. Invest what you’re comfortable with losing, and avoid becoming overly attached to any one coin.

Future of Cryptocurrency

The future of cryptocurrency remains uncertain, but several potential scenarios could unfold:

Dominant Form of Money: Cryptocurrency could become the dominant form of money worldwide, adopted by individuals and businesses. Central banks might hold crypto reserves, and international trade may rely primarily on cryptocurrency.

Niche Payment System: Cryptocurrency could remain a niche payment system predominantly used by tech-savvy individuals and businesses. Central banks may not hold crypto reserves, and fiat currencies could still dominate international trade.

Banned: Governments might crack down on cryptocurrency, perceiving it as threatening financial stability. In this scenario, cryptocurrency could be prohibited, with strict regulations imposed and severe penalties for possession.

Obsolete: Cryptocurrency could fail to gain widespread adoption and fade into obscurity. Central banks would not hold crypto reserves, and international trade would rely on fiat currencies.

Cryptocurrency Mining: How to Earn Digital Assets

Cryptocurrency mining is the process of creating new cryptocurrency through computational work. Miners use specialized hardware and software to verify and add transactions to the blockchain.

If you’re interested in mining cryptocurrency, consider the following:

Hardware and Software: Ensure your computer has the hardware and software to mine cryptocurrency efficiently.

Electricity Costs: Mining cryptocurrency requires significant computing power, which consumes electricity. Consider the associated electricity costs and evaluate their impact on profitability.

Mining Pools: Joining a mining pool increases the chances of earning cryptocurrency rewards. Mining pools combine computational power to solve complex algorithms and distribute prizes among participants.

Mining Calculator: Use a cryptocurrency mining calculator to estimate potential earnings and evaluate the profitability of your mining operation.

Investment: Cryptocurrency mining demands both time and money. Be prepared to invest in specialized mining equipment and dedicate time to monitor and maintain your mining operation.

Cryptocurrency mining offers an opportunity to earn digital assets, but assessing the risks and rewards is crucial before venturing into this field.

In conclusion, cryptocurrency and its underlying technology, blockchain, have the potential to reshape various industries. Understanding the blockchain, its technology, investment strategies, potential futures, and mining can empower individuals to successfully navigate this rapidly evolving landscape. Stay informed, stay cautious, and embrace the possibilities that cryptocurrency brings to the world.

The Unforeseen Surge of Cryptocurrency

Cryptocurrencies, those enigmatic digital or virtual tokens, have embarked on a journey that defies expectations.

With the ingenious application of cryptography to secure transactions and control the creation of new units, cryptocurrencies have emerged as decentralized entities, unburdened by government or financial institution control.

It was in 2009 that the pioneering and illustrious cryptocurrency, Bitcoin, sprang into existence, marking the inception of this fascinating realm.

Decentralized exchanges have become the bustling hubs where cryptocurrency trades, enabling them to transcend the boundaries of mere digital assets.

Their utility has expanded to encompass the realm of commerce, as cryptocurrencies like Bitcoin can be employed to reserve accommodations through Expedia, furnish living spaces via Overstock, and procure exhilarating Xbox games.

And as the adoption of cryptocurrencies continues its upward trajectory, more and more merchants are embracing cryptocurrency payments, signaling a remarkable paradigm shift.

Nonetheless, it is essential to acknowledge the inherent volatility that permeates the cryptocurrency landscape.

The erratic nature of cryptocurrency prices ushers in dramatic fluctuations, rendering them enticing to some as investments but also harboring substantial risks.

One must approach cryptocurrency trading with a discerning eye, acknowledging its speculative and intricate nature, which may render it unsuitable for every individual.

Safeguarding Your Precious Cryptocurrency

To trade cryptocurrencies prudently, you must thoroughly ponder your investment objectives, gauge your experience level, and assess your risk appetite.

The meteoric ascent of cryptocurrency has undeniably been awe-inspiring, propelling once-obscure entities like Bitcoin, Ethereum, and Litecoin into common knowledge and everyday discourse.

The surging interest in digital currencies has ushered in a surge of individuals seeking to invest in these fascinating assets. However, as with any investment endeavor, risks invariably lurk within the shadows.

A paramount concern when investing in cryptocurrency revolves around its relatively nascent and unproven status as an asset class. The absence of regulation and investor protection within this domain exacerbates the potential risks that investors face.

The volatility ingrained in cryptocurrency markets is another formidable hurdle to navigate. Cryptocurrency price fluctuations are notorious for their wild oscillations, and without reasonable caution, these fluctuations can inflict significant losses upon the unprepared.

Essential Measures for Safeguarding Your Cryptocurrency Investments

Moreover, the absence of central authorities to oversee cryptocurrency exchanges opens the door to the specter of fraud, amplifying the risks inherent in any investment undertaking.

So, what measures can one undertake to shield themselves when embarking on the captivating realm of cryptocurrency investment?

The journey commences with thorough research. Inundate yourself with knowledge and fully comprehend the risks entwined within this volatile realm before taking the plunge and committing your funds.

Once you fully grasp the perils, consider diversifying your investment portfolio. Embrace the wisdom of not staking all your fortunes on a solitary venture, and explore the prospects of investing in an array of cryptocurrencies.

Additionally, it is prudent to seek reputable exchanges offering robust security measures. By opting for such deals, you fortify your defenses against the perils of hacks and fraudulent activities, thus safeguarding your hard-earned capital.

Lastly, pay attention to the importance of vigilance. The mercurial nature of cryptocurrencies necessitates that you remain abreast of the latest developments, keeping a watchful eye on news and prices that could dictate the fate of your investments.

By heeding these simple yet indispensable guidelines, you erect a protective shield against the potential risks woven into the intricate tapestry of cryptocurrency investment.

Unraveling the Regulatory Maze: Navigating Challenges in the Cryptocurrency Landscape

The Regulatory Quagmire: Navigating Legal Considerations in the Landscape Cryptocurrency.

Cryptocurrencies, those captivating digital assets fortified by the prowess of cryptography to secure transactions and govern the creation of fresh units, transcend the realms of centralized governance imposed by governments or financial institutions.

Bitcoin, the vanguard and the indubitable standard-bearer of cryptocurrencies materialized in 2009, engendering an avalanche of transformative possibilities.

Since then, a plethora of cryptocurrencies has seen the light of day. As of June 2018, an astonishing ensemble of over 1,600 cryptocurrencies graced the scene, amassing a staggering market capitalization of more than $275 billion.

These digital wonders are exchanged on dedicated platforms and serve to acquire goods and services, further broadening their appeal.

Yet, owing to their decentralized nature, cryptocurrencies have inevitably become trapped in the web of illicit activities such as money laundering and illegal drug trade.

Must Read: The Rise and Fall of Bitcoin

Consequently, governments worldwide have intensified their efforts to regulate the cryptocurrency landscape, aiming to curtail the exploitation of this transformative realm.

Regulatory Bodies Behind Cryptocurrency

In the United States, the Securities and Exchange Commission (SEC) emerged as the preeminent regulatory body that has assumed an active role in overseeing cryptocurrencies.

It has diligently pursued enforcement actions against Initial Coin Offerings (ICOs) suspected of violating securities laws, spearheading a campaign to safeguard investors.

Furthermore, the SEC is actively contemplating classifying cryptocurrencies as securities, a pivotal determination requiring exchanges to register with the SEC.

The Commodity Futures Trading Commission (CFTC) has also emerged as a formidable figure in the regulatory landscape, asserting its authority by designating Bitcoin as a commodity.

It has likewise instigated enforcement actions against ICOs that transgress the bounds of commodities laws, firmly establishing its regulatory prowess.

On the tax front, the Internal Revenue Service (IRS) has proffered guidance regarding the taxation of cryptocurrencies, decreeing that they should treat as property for tax purposes.

Thus, the gains or losses realized from the sale or exchange of cryptocurrencies are subject to the ever-watchful gaze of capital gains taxes.

State and local jurisdictions have also waded into the regulatory arena, carving out their unique paths. Notably, New York has introduced BitLicense, mandating that cryptocurrency businesses obtain licenses, ensuring compliance with regulatory provisions.

As the widespread adoption of cryptocurrencies continues its relentless advance, regulatory frameworks at the federal, state, and local levels will inevitably assume greater prominence, aiming to foster a harmonious coexistence between this burgeoning digital realm and the intricate tapestry of laws governing our society.