Machine learning has the potential to revolutionize investment management, but many professionals in the field are still trying to grasp its concepts and applications. In this article, we will provide an overview of machine learning training methods and present a decision-making flowchart that can guide the selection of appropriate approaches based on the desired outcomes.

Key Points:

- Ensemble learning combines predictions from multiple algorithms to enhance accuracy and stability of predictions.

- Reinforcement learning utilizes trial-and-error methods to distill insights and maximize rewards over time.

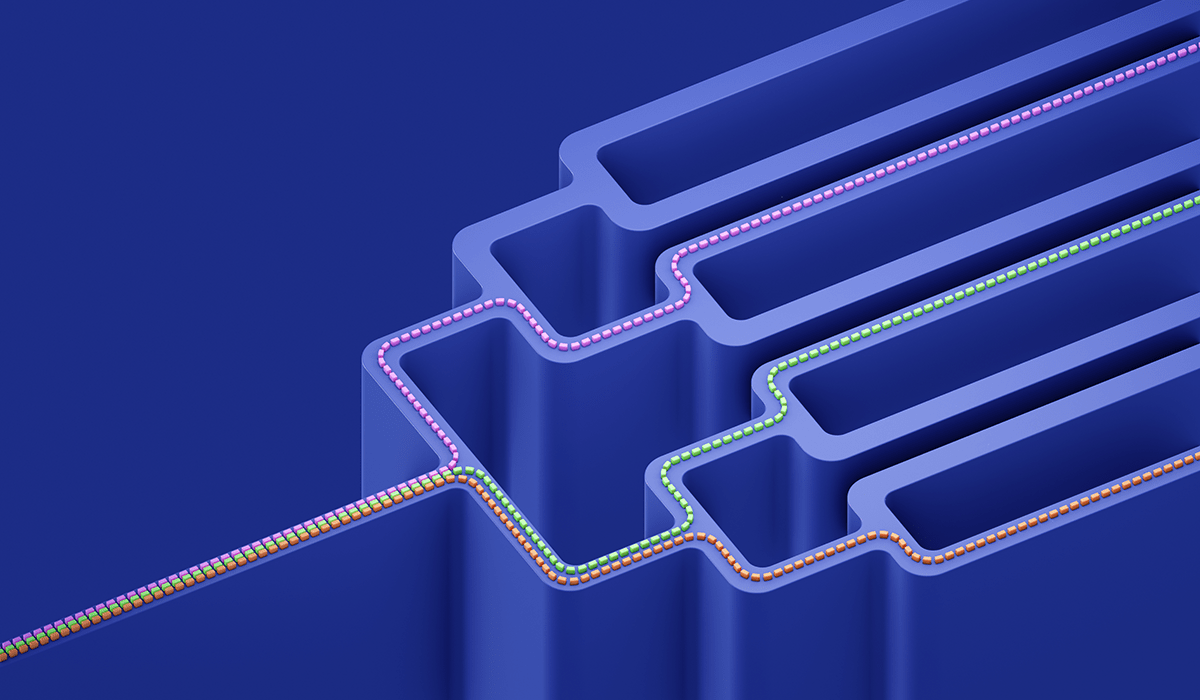

Machine learning decision-making flowchart involves several steps, including principal component analysis, natural language processing, regression techniques, deep learning, classification and regression trees, cluster analysis, and support vector machines.

Machine Learning Training Methods

1. Ensemble Learning

- Ensemble learning is a technique that combines predictions from different algorithms to reduce errors and noise, resulting in more accurate and stable predictions.

- Ensemble learning can use either heterogeneous or homogeneous learners. Heterogeneous learners combine different types of algorithms with a voting classifier, while homogeneous learners combine the same algorithm with different training data using bootstrap aggregating technique.

2. Reinforcement Learning

- Reinforcement learning involves trial-and-error methods to maximize rewards over time.

- Reinforcement learning algorithms interact with each other and learn from their own data.

- This approach can employ supervised or unsupervised deep neural networks to enhance learning capabilities.

Reinforcement learning gained attention when DeepMind’s AlphaGo program defeated the world champion in the game of Go. The algorithm used in AlphaGo takes into account both rewards and constraints in its decision-making process.

Reinforcement learning with unsupervised learning does not rely on labeled data and depends on trial and error to gather insights.

However, applying reinforcement learning to financial markets is still an open question.

Machine Learning Decision-Making Flowchart

Footnotes

1. Principal component analysis (PCA) is a technique that helps reduce the complexity of prediction models by selecting the most significant features. It transforms the data to a new basis where the principal components with the highest explanatory power are chosen. Inputs in machine learning are referred to as features, while in traditional statistical methods, they are called explanatory or independent variables.

2. Natural language processing (NLP) encompasses various techniques, including sentiment analysis, to analyze textual data. It involves both supervised and unsupervised learning steps.

3. Simple or multiple linear regression without regularization is considered a traditional statistical technique rather than a machine learning method.

4. Lasso regression (L1 regularization) and ridge regression (L2 regularization) are techniques used to prevent overfitting in prediction models. Lasso regression reduces the number of features, while ridge regression maintains the number of features. Both techniques can be applied in statistical methods and machine learning to handle non-linear relationships between targets and features.

5. Deep learning refers to machine learning applications that utilize deep neural networks (DNNs). It involves continuous numerical target values and hyperparameters that need human optimization.

6. Classification and regression trees (CARTs) and random forests are algorithms used for discrete or categorical target values.

7. The number of clusters in hierarchical clustering is determined by the algorithm, not by direct human input.

8. The K-nearest neighbors (KNN) algorithm can also be used for regression, but it is not included in this flowchart for simplicity.

9. Support vector machines (SVMs) are supervised learning methods that can be used for linear and non-linear classification as well as regression.

10. Naïve Bayes classifiers apply strong (naïve) independence assumptions between features and utilize probabilistic methods.

References

Kathleen DeRose, CFA, Matthew Dixon, PhD, FRM, and Christophe Le Lannou. 2021. “Machine Learning.” CFA Institute Refresher Reading. 2022 CFA Program Level II, Reading 4.

Robert Kissell, PhD, and Barbara J. Mack. 2019. “Fintech in Investment Management.” CFA Institute Refresher Reading, 2022 CFA Program Level I, Reading 55.

All posts are the opinion of the author and should not be considered as investment advice.

Image credit: ©Getty Images/Jorg Greuel

Professional Learning for CFA Institute Members

CFA Institute members can record professional learning credits using their online PL tracker.