Last updated on July 23rd, 2023 at 09:14 am

Bitcoin, a groundbreaking cryptocurrency and payment system, emerged in 2008, originating from the enigmatic mind of an anonymous individual or a group known as Satoshi Nakamoto.

Table of Contents

Unveiling an unprecedented decentralized framework, Bitcoin transcends traditional financial paradigms. Free from the grasp of central authorities and intermediaries, transactions are validated through cryptographic processes and meticulously recorded within an extensively dispersed public ledger referred to as the blockchain. Notably, the remarkable feature of Bitcoin lies in its fixed supply limit, capped at 21 million units.

Intriguingly, Bitcoin is a reward for the intricate mining process, which serves as the bedrock of its creation—subsequently, these digital assets exchange for various currencies, products, and services.

The Intricacies of Bitcoin’s Functionality

Analyzing Bitcoin’s internal operations reveals that it functions as a decentralized digital currency and electronic cash. Bitcoin enables direct peer-to-peer transactions on its network, eliminating the need for intermediaries and operating outside of the purview of centralized institutions or single administrators.

Implement specific measures to ensure the integrity of these transactions. Network nodes employ cryptographic protocols to verify and secure them within the distributed public ledger, the blockchain. Satoshi Nakamoto, the enigmatic creator of Bitcoin, introduced this transformative concept in 2008.

Similar to the prior discourse, Bitcoin’s creation remains rooted in mining, rewarding participants with new Bitcoins. The versatility of these digital assets enables their exchange for a myriad of currencies, products, and services.

Moreover, the proliferation of Bitcoin adoption is evident, with over 100,000 merchants and vendors accepting it as a means of payment. Facilitating access to Bitcoin is acquired through digital exchanges or Bitcoin ATMs.

Emphasizing its unique nature, Bitcoin possesses a finite quantity, capped at 21 million units. This inherent scarcity contributes to its allure and potential value appreciation, making it an intriguing investment option.

Unlocking the Potential of Bitcoin Investment

Venturing into the realm of Bitcoin investment holds promise for many reasons. Satoshi Nakamoto’s brainchild, Bitcoin, transcends conventional boundaries, providing a decentralized global currency unaffected by the restrictions imposed by individual nations.

Additionally, Bitcoin’s scarcity positions it as a coveted asset akin to valuable commodities like gold. As demand for Bitcoin escalates, its value follows suit.

The decentralized nature of Bitcoin shields it from the clutches of governmental regulations, fostering resilience against censorship and manipulation, a defining characteristic of this revolutionary digital asset.

Furthermore, Bitcoin transactions operate with heightened privacy and swiftness, ensuring confidentiality for both parties. Unlike traditional banking channels, Bitcoin transactions conclude within minutes, making it an appealing choice for cross-border transfers.

One of Bitcoin’s remarkable attributes lies in its unparalleled transparency. Each transaction is immutably recorded on the blockchain, guaranteeing visibility and validating the integrity of the entire network.

Undeniably, the finite supply of 21 million Bitcoins underscores its desirability and potential as a long-term investment option, enticing individuals seeking to preserve and grow their wealth.

How to invest in Bitcoin?

Originating from the innovative mind of Satoshi Nakamoto, Bitcoin stands as a digital asset and payment system of unparalleled magnitude. Transacting parties rely on network nodes fortified by the marvels of cryptography, which proceed to meticulously authenticate and duly record these transactions in an openly accessible distributed ledger aptly christened the blockchain.

The mining process bestows humanity the gift of newly minted Bitcoins, a reward for their tenacious endeavors. These digital treasures effortlessly traverse realms, seamlessly metamorphosing into traditional currencies, commodities, or sought-after services.

To acquire the coveted Bitcoin, one may embark upon a quest in person or within the vast expanse of the digital realm.

Countless exchanges and wallets await the intrepid investor. The talks serve as enclaves wherein enthusiasts may navigate a multitude of currencies, engaging in the buying and selling Bitcoin, a captivating dance of financial prowess.

Bitcoin Investment is an Alternative Asset

Meanwhile, wallets, revered as the guardians of digital riches, undertake the pivotal role of storage and transfer. These virtual vessels manifest in two distinctive forms: the ethereal realm of software and the tangible domain of hardware.

Software wallets manifest as applications or web-based portals, accessible with few clicks or taps, unveiling the wonders of secure Bitcoin management.

Conversely, the hardware wallets manifest as corporeal devices embodying the embodiment of security, which encase and safeguard the fleeting essence of Bitcoin.

Embarking upon the realm of Bitcoin investment mirrors the pursuit of any alternative asset class. Its alluring facets entice investors to traverse the meandering pathways of exchanges or to deploy their newfound wealth in the quest for tangible goods and services.

Indeed, Bitcoin assumes the mantle of a captivating investment vehicle, an instrument of financial prosperity.

However, it is crucial to note that Bitcoin, like a stormy tempest, grapples with the whims of volatility, effortlessly oscillating and careening within the ethereal realm of the market.

Hence, embarking upon a Bitcoin investment journey entails an inherent element of risk, demanding meticulous research and an unwavering comprehension of the perils of wait.

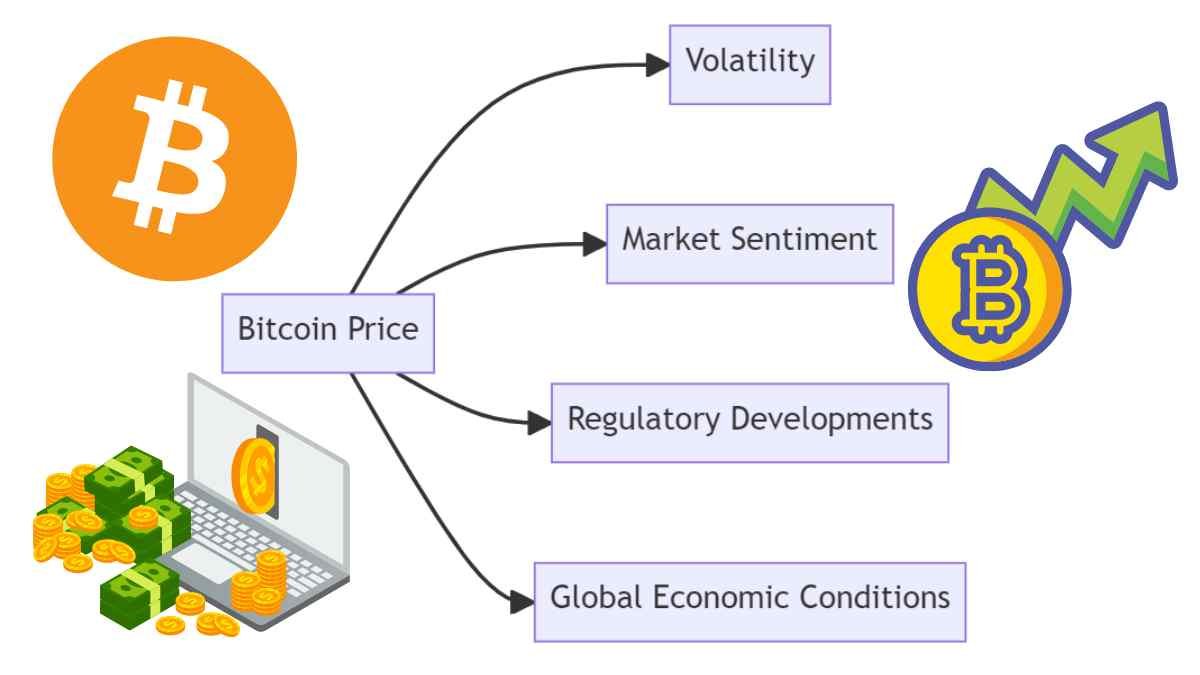

Navigating the Risks Inherent in Bitcoin Purchase

While Bitcoin investment offers significant prospects, it is vital to acknowledge the associated risks.

Engaging in Bitcoin endeavors necessitates careful consideration and an understanding of the following key factors:

Volatility: Bitcoin’s value is renowned for its extreme volatility, fluctuating substantially within short spans. Consequently, its unpredictable nature exposes investors to potential losses.

Security: Entrusting one’s Bitcoin holdings to exchanges or wallets entails inherent security risks. Hacks and the loss of private keys pose threats that can irrevocably lose one’s entire Bitcoin portfolio.

Regulation: Due to its nascent nature, Bitcoin’s regulatory landscape remains to be determined. Future governmental regulations can impact its price and accessibility, complicating the buying and selling.

Risks Including Scams, Forks & Market Manipulation

Scams: The realm of Bitcoin is rife with fraudulent schemes, ranging from Ponzi schemes to counterfeit wallets and exchanges. Diligence and thorough research are essential to avoid falling victim to such scams.

Taxes: Investors profiting from Bitcoin transactions may be subject to capital gains taxes, necessitating compliance with the ever-evolving tax laws within their jurisdictions.

Forks: Bitcoin’s open-source nature enables the creation of derivative versions, leading to chain splits such as Bitcoin Cash and Gold. Failure to claim these forked coins can result in their permanent loss.

Market Manipulation: Bitcoin’s relatively small market capitalization renders it susceptible to manipulation by influential entities. Artificially inflated or deflated prices hinder fair transactions, challenging investors seeking equitable trades.

By carefully navigating these risks and staying informed, individuals can make well-informed decisions while engaging with Bitcoin.

Benefits of Bitcoin Purchase

Bitcoin purchases for various reasons. The primary purpose is to invest in Bitcoin and make a profit in the future. Here are the six benefits of Bitcoin purchase:

- Bitcoin is a global currency

The first and most important benefit is that Bitcoin is a global currency. It is not subject to any country’s regulations or laws. That means anyone in any part of the world can buy Bitcoin.

- Bitcoin is scarce

Bitcoin is a scarce asset. There will only ever be 21 million Bitcoin, which makes it similar to gold and other precious metals. As demand for Bitcoin increases, so does its price.

- Bitcoin is decentralized

Bitcoin is a decentralized asset. Any government or financial institution does not control it, making it resistant to censorship and manipulation.

- Bitcoin is private

When you buy Bitcoin, your transaction is private. Unlike traditional fiat currencies, which governments regulate, only you and the person you are sending Bitcoin to know about the marketing.

- Bitcoin is fast

Bitcoin transactions are fast. They confirm within minutes, much faster than traditional bank transfers, which can take days or weeks.

- Bitcoin is easy to use

Bitcoin is easy to use. You don’t need to have any prior knowledge of finance or technology. All you need is a Bitcoin wallet and an internet connection.

Immense Potential: The Multifaceted Power of Bitcoin Acquisition

Bitcoin, the unrivaled global currency, has emerged as a financial game-changer.

Brace yourself for a paradigm shift as Bitcoin gracefully paves the way to revolutionize purchasing goods and services.

A decentralized phenomenon, Bitcoin commands the stage, unleashing a new era of financial freedom.

Behold the cloak of privacy that Bitcoin bestows upon its users, securing transactions with utmost precision.

Step into Bitcoin’s fortress of unassailable security, providing unparalleled confidence in the digital realm.

Embracing the Renaissance: Bitcoin as the Epitome of Value Storage

Prepare to witness the meteoric rise of Bitcoin as it captivates hearts and minds, propelling it to unparalleled heights. With the value of a single Bitcoin surpassing the astonishing $17,000 mark, the world is fascinated by its allure, beckoning even the most conservative individuals to contemplate investing in this digital marvel.

The burning question on everyone’s lips: Can Bitcoin genuinely serve as a beacon for storing value? Unquestionably, the answer resounds with a resounding affirmation. Bitcoin, indeed, possesses the key to keeping weight, a compelling reason why it has captured the imagination of the masses.

Peer into the intricate web that weaves the fabric of Bitcoin’s attributes as a store of value.

Bitcoin’s allure stems from its limited supply, embracing the essence of scarcity. Merely 21 million Bitcoins can ever exist, a testament to the meticulous design embedded within the Bitcoin code. In stark contrast, fiat currencies suffer from the whimsical impulses of central banks, perpetually susceptible to inflationary measures, diminishing their value over time. Rest assured, Bitcoin, in its scarcity, boasts an ascent in value as demand surges—an undeniable testimony to its superiority over fiat currencies.

Moreover, durability stands as an emblem of Bitcoin’s resilience. Similar to the timeless luster of gold, Bitcoin withstood the test of time and emerged victorious. The robustness of Bitcoin’s design, fortified by its blockchain technology, instills trust and confidence in its ability to endure.

Embracing Velocity: Unveiling the Swiftness and Irreversibility of Bitcoin Transactions

Behold the dawn of a new era, where Bitcoin transactions embody practicality and immutability, leaving traditional payment methods, such as credit cards and PayPal, gasping for breath. Witness the swift and irrevocable nature of Bitcoin transactions through these awe-inspiring examples:

With Bitcoin, sending funds to another individual manifests as an instantaneous spectacle. Within mere minutes, the recipient’s coffers overflow with the Bitcoin goodness, while the transaction elegantly inscribes itself within the blockchain’s tapestry, leaving an indelible mark within 10 minutes.

Once a Bitcoin transaction confirms its legitimacy, the gates of irrevocability swing open, sealing the deal indefinitely. Should an accidental Bitcoin transfer occur, the hands of time stand still, preventing any rescission.

Enter the realm of unparalleled speed and liberty. Unlike conventional payment methods entangled in a web of fees and delays, Bitcoin illuminates the path with its feeless and expeditious nature, surpassing all expectations.

Unveiling the Enigma: Bitcoin Transactions Dance in the Shadows

Embarking upon the labyrinth of Bitcoin, one cannot overlook the enigma that shrouds its transactions—privacy. Within this cryptic world, Bitcoin privacy emerges as the vanguard, safeguarding identities and personal information, ensuring a seamless user experience.

Enter the realm of Bitcoin mixers, the guardians of anonymity. These ethereal beings intertwine your Bitcoin with that of other users, making tracing the origins and destinations of your Bitcoin an insurmountable challenge, an impenetrable fortress.

However, contemplate the anonymity of your Bitcoin transactions and the labyrinthine tapestry they traverse. Contrary to popular belief, Bitcoin transactions do not cloak themselves in anonymity. Each transaction finds its way onto the Bitcoin blockchain, a public ledger where personal information intertwines with Bitcoin’s journey.

Fear not, for a knight in shining armor emerges—Bitcoin mixers, the pinnacle of privacy preservation. CoinJoin, the stalwart of anonymity, invites Bitcoin enthusiasts to unite their digital treasures, engaging in transactions that shield personal information from prying eyes.

CoinJoin is a luminous beacon amidst other available methods, but the path to privacy remains yours. Embrace the realm of Bitcoin proxies and their anonymity, for they, too, unlock the gates to a private haven, safeguarding your Bitcoin transactions from unwelcome scrutiny.

Unleashing the Potential: Bitcoin’s Transformation into an Interest-Earning Asset

Embark upon the limitless horizons of Bitcoin acquisition, where the coveted rewards of interest await. Within this realm, countless avenues flourish, each offering a unique opportunity to lend your Bitcoins, reaping the benefits of accrued interest. Traverse the landscape and discover platforms teeming with potential, assuring an additional stream of income that knows no bounds.

Immerse yourself in the Bitcoin revolution, where five remarkable benefits intertwine to form a tapestry of financial prosperity:

Unlock the doors to a world of interest-bearing possibilities, for Bitcoin’s allure transcends mere value storage.

Witness the metamorphosis of Bitcoin as it gracefully takes center stage, emerging as the catalyst for an era where goods and services are at your fingertips, awaiting your digital touch.

Engage in a symphony of seamless transactions where sending and receiving payments soar to new heights, unbound by the constraints of traditional methods.

Shield your financial well-being from the tumultuous waves of inflation, for Bitcoin stands resolute as the fortress against the relentless erosion of value.

Embrace the essence of security as Bitcoin wraps itself around your digital assets, serving as an unwavering guardian of value, shielding you from the turbulent storms of uncertainty.

Conclusion

In conclusion, Bitcoin’s emergence as a complex and revolutionary cryptocurrency has captivated the global financial landscape. It upends traditional systems by embracing decentralization, immutability, and privacy. Although rife with risks, Bitcoin’s popularity continues to soar, driven by its potential as a global currency and an investment vehicle for the future.