Last updated on August 1st, 2023 at 04:42 am

In recent weeks, cryptocurrencies have witnessed significant developments, with Bitcoin experiencing a notable drop followed by a modest recovery. Additionally, Ripple’s recent legal victory against the SEC has generated considerable interest and raised questions about the future of digital currencies.

Table of Contents

As experts in the field, we aim to provide you with a comprehensive analysis of these events and their potential implications for the crypto market.

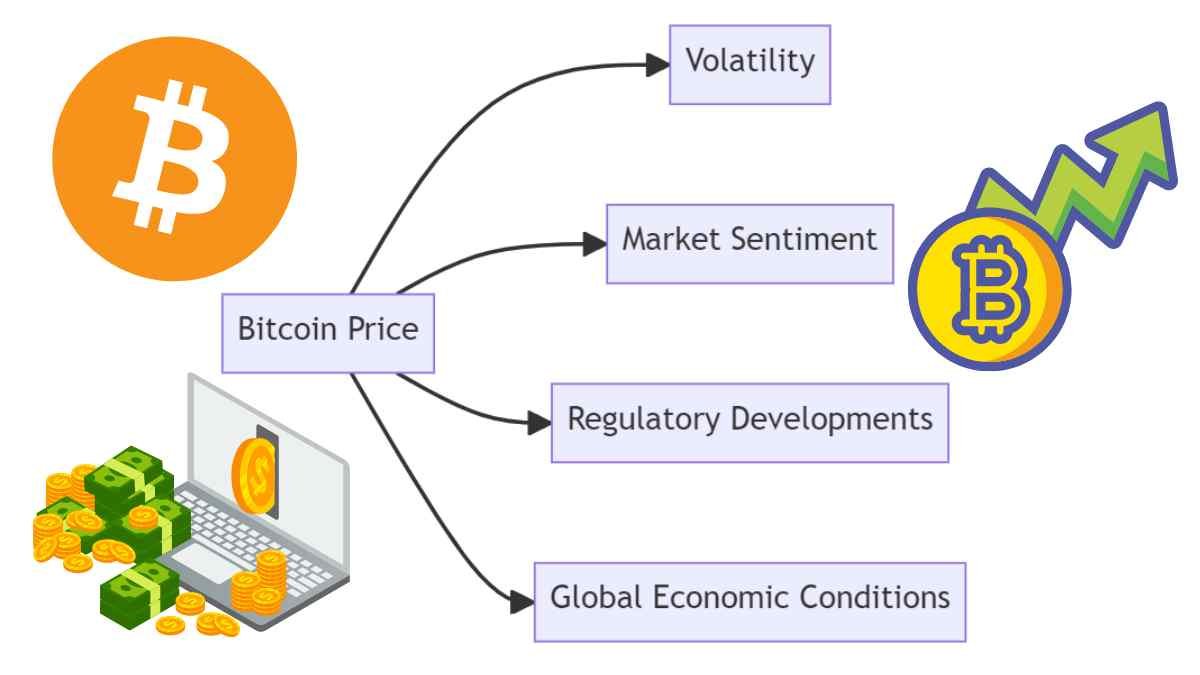

Bitcoin’s Price Fluctuations and the Impact of Ripple’s Legal Victory

The pioneering cryptocurrency recently faced a decline substantially, reaching its lowest since late June. However, despite this setback, it managed to regain some ground.

It’s worth noting that Ripple’s legal victory against the Securities and Exchange Commission (SEC) did not have a lasting positive impact on Bitcoin’s price.

Analysts predict that Bitcoin may continue to face downward pressure until the SEC approves a spot Bitcoin exchange-traded fund (ETF).

The approval process for such an ETF is ongoing, with the SEC exercising caution and deliberating the associated risks.

The crypto community awaits this decision, which could boost Bitcoin’s price and open new avenues for investors.

Ripple’s Legal Victory and Its Impact on the Market

The blockchain-based payment protocol Ripple achieved a significant legal milestone by winning its case against the SEC.

This victory has sparked renewed optimism within the crypto community and has had ripple effects (pun intended) on the market.

In the aftermath of Ripple’s legal win, XRP, the native cryptocurrency of the Ripple network, surpassed Binance Coin (BNB) in terms of market capitalization.

This development highlights the potential resilience of XRP and underscores the growing confidence in Ripple’s ability to navigate regulatory challenges successfully.

However, experts express concerns about potential obstacles hindering the SEC’s approval of a Bitcoin ETF. While Ripple’s legal victory is a positive precedent, the regulatory landscape remains complex and subject to ongoing scrutiny.

It is crucial to closely monitor the developments surrounding the SEC’s decision-making process, as it will significantly impact the trajectory of the crypto market.

Law Enforcement and Crypto Scams: Promoting Crypto Literacy and Combating Fraud

Jarek Jakubcek, the head of Binance Law Enforcement Training, is actively combating global crypto scams by providing specialized training to law enforcement officers in the Asia Pacific region.

Jakubcek emphasizes the importance of crypto literacy and raising awareness about cryptocurrency risks.

Law enforcement agencies have achieved notable success in investigating crypto crimes thanks to the transparency of blockchain technology.

By tracking wallets and requesting know-your-customer (KYC) data from exchanges, investigators can more effectively identify and apprehend those involved in fraudulent activities.

Interestingly, these methods have proven more fruitful than traditional approaches focused solely on tracing IP addresses.

Unfortunately, law enforcement faces challenges from fraudulent individuals who pose as private investigators.

These deceptive practices underscore the need for continued vigilance and collaboration between law enforcement agencies, cryptocurrency exchanges, and the wider crypto community.

Market Developments: BNB Futures, Binance’s Partnership, and Economic Indicators

Beyond Bitcoin and Ripple’s legal victory, several noteworthy events have unfolded in the crypto and financial markets.

Funding rates for Binance Coin (BNB) perpetual futures have shown negativity, reflecting the cautious sentiment surrounding this cryptocurrency.

Investors and traders closely monitor these rates as they provide insights into market dynamics and potential price movements.

In a recent decision, Binance, one of the leading cryptocurrency exchanges, terminated its partnership with Argentina’s soccer association.

This development comes as Binance navigates the evolving regulatory landscape and seeks to ensure compliance with local laws and regulations.

Furthermore, investors closely monitor key economic indicators such as jobs, retail sales, and production data to gain insights into inflation trends.

These indicators provide valuable information for decision-making and help shape market expectations.

SEC Chairman Gensler’s Assessment and Ongoing Evaluation

SEC Chairman Gary Gensler has expressed disappointment with certain aspects of the Ripple judgment. The specifics of his concerns have yet to disclose fully; it is evident that he is carefully evaluating the opinion and its potential implications for the broader regulatory framework governing cryptocurrencies.

As the SEC plays a vital role in shaping the crypto landscape, Chairman Gensler’s assessment and subsequent actions will significantly influence market dynamics and investor sentiment.

Industry participants and observers must stay informed about regulatory developments and adapt their strategies accordingly.

Conclusion

In summary, recent events have highlighted the dynamic nature of the crypto market and its intersection with regulatory frameworks. Bitcoin’s price fluctuations and Ripple’s legal victory have captivated the attention of investors and industry insiders alike. As we await the SEC’s decision regarding a Bitcoin ETF, the market continues evolving, presenting challenges and opportunities.

Law enforcement agencies, led by experts such as Jarek Jakubcek, are actively combating crypto scams and emphasizing the importance of crypto literacy. While obstacles remain, the transparency of blockchain technology offers valuable tools for investigating and preventing fraudulent activities.

Meanwhile, developments in the crypto space, including BNB futures funding rates, Binance’s partnership terminations, and economic indicators, further shape market sentiment and provide valuable insights for market participants.

Ultimately, staying informed and adapting to changing market conditions and regulatory landscapes is essential for individuals and businesses navigating the dynamic world of cryptocurrencies.