Key Points

- Short squeezes have become a popular investment tactic in recent years, with the GameStop short squeeze being a notable example.

- In addition to high short interest and thin trading, macro conditions and speculative technologies play a role in short squeeze activity.

- Periods of market uncertainty, such as during the global financial crisis or amid the COVID-19 pandemic, tend to coincide with increased short squeezes.

- Biotech and software sectors, which rely on unproven technologies, are more prone to short squeezes compared to sectors with established business models.

- Identifying a short squeeze requires considering whether a stock is being shorted, its liquidity, reliance on unproven technology, and the stability of macro conditions.

- Short squeezes are unpredictable and their trajectories uncertain, making them challenging to catch and ride successfully.

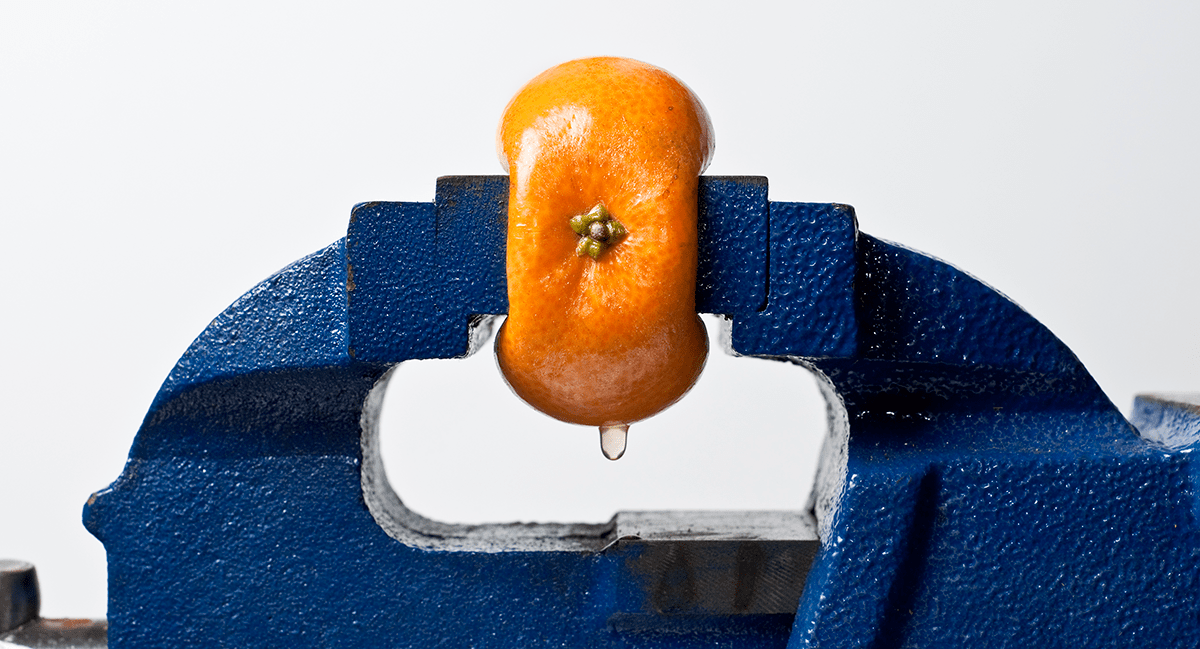

Anticipating and participating in short squeezes has become a popular investment strategy in recent times, with the GameStop saga serving as a prime example of this phenomenon. However, apart from the well-known factors of high short interest and thin trading, our analysis suggests that two additional factors influence short squeeze activity: macro conditions and speculative technologies.

Our research indicates that short squeezes are more likely to occur during periods of market uncertainty. This was evident during the global financial crisis, the dot-com bubble, and the COVID-19 pandemic, where short squeezes were more prevalent. It seems that when the larger economy and financial markets are experiencing tumultuous times, short squeezes tend to thrive.

In addition, we found that certain sectors are more susceptible to short squeezes due to their reliance on speculative and unproven technologies. Biotech and software sectors, for example, have witnessed higher occurrences of short squeezes compared to sectors with established and well-understood business models. The inherent uncertainty and speculation surrounding these technologies make them attractive targets for short-squeezers.

To determine whether a stock is likely to become a short squeeze target, investors should consider four key criteria. Firstly, is the stock being heavily shorted? Secondly, is it thinly traded? Thirdly, does it rely on unproven technology? Finally, are macro conditions particularly unstable? If these four factors align, there is a higher chance of a short squeeze, although predicting one remains a difficult task.

It is important to note that short squeezes are not common occurrences, and even if all the criteria align, there is no guarantee of success. The trajectory and timing of a short squeeze are uncertain, and investors should be cautious about relying too heavily on catching and riding these waves. As the GameStop short squeeze demonstrated, there are always outliers that can defy expectations.

In conclusion, while short squeezes can present lucrative opportunities, they are challenging to predict and navigate. Understanding the factors that contribute to short squeeze activity can provide investors with valuable insights, but caution and careful consideration are essential when engaging in such strategies.